Business, Commercial & Home Finance for SMEs - Duo Finance

Call Us 1300-624-041

The Victorian ‘Home Buyer Fund’

The ‘Home Buyer Fund’ is a Victorian Government initiative to assist eligible homebuyers. The scheme allows buyers to have a deposit as small as 5% of their purchase price, whilst still being able to avoid costly Lenders Mortgage Insurance through these government contributions.

The Fund offers contributions through a ‘shared equity scheme’. This scheme means that the fund contributes a share of the property value, the value of the Fund’s share will vary accordingly as the value of the property changes.

The property must be a standard residential property such as a house, townhouse, unit, or apartment, vacant land is not eligible for this scheme.

The maximum purchase price of the home is up to $950,000 in Metropolitan Melbourne and Geelong and up to $600,000 in eligible regional Victoria. Click this link for further information on the eligible locations across Metropolitan Melbourne, Geelong and regional Victoria.

Home Buyer and Fund Contributions:

The typical minimum deposit for this scheme is 5% for the homebuyer. The minimum deposit is reduced to 3.5% for eligible Aboriginal or Torres Strait Islander people.

To create a viable deposit, the ‘Home Buyer Fund’ contributes up to 25% or up to 35% for eligible Aboriginal or Torres Strait Islander homebuyers.

Important things to keep in mind:

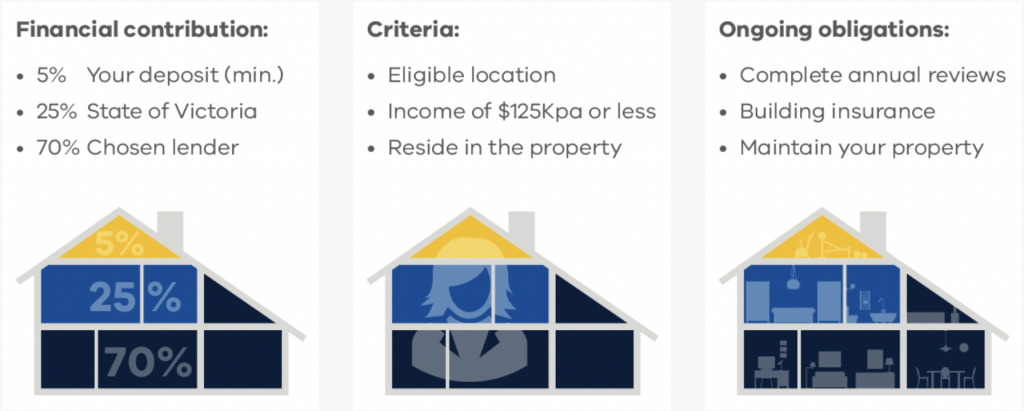

Successful participants are expected to financially contribute a minimum of 5% of the deposit. The Victorian Government will contribute 25% and the chosen lender will financially contribute the remaining 70%.

The criteria for the ‘Home Buyer Fund’ stipulates that homebuyers must choose a location within the eligible locations list, earn $125,000 or less per annum and reside in the property they purchase.

Successful participants also have an ongoing obligation to be responsible for completing annual reviews to maintain eligibility, providing proof of building or property insurance, and overall property maintenance.

Source: https://www.sro.vic.gov.au/homebuyer

Repaying the ‘Home Buyer Fund’ share (Criteria Apply):

There are a number of ways that the fund’s share of the property can be repaid:

- Through refinancing

- Using savings to make payments toward the Fund’s portion

- When the property is sold.

In this case, the money is distributed to the following entities in this order:

- Your bank/lender to pay off your remaining home loan

- The Homebuyer Fund to pay back its share in your property

- Anyone else with a legal or equitable interest in the property, such as council rates

- The homebuyer

Lenders that are currently participating in this government initiative are Bank Australia and Bendigo Bank.

If you are interested in using this ‘Home Buyer Fund’ initiative to purchase a property, contact Duo Finance today to discuss your next steps.