Business, Commercial & Home Finance for SMEs - Duo Finance

Call Us 1300-624-041

Self-Managed Super Funds (SMSF) and borrowing

SMSF, what is it?

SMSF stands for Self-Managed Superfund.

As they name suggests, Self-Managed Superfund provides you the control over your super and the investments it makes. With that said, its important you seek the expert advice of an experienced Financial Advisor to help guide you and ensure you are aware of the opportunities and pitfalls that come with an SMSF.

If you have never heard of an SMSF don’t be worried, most people would not have one as most of us have our super in an Industry fund or Managed fund. However, recent data suggests this could be changing and according to the ATO’s June 2020 figures, the number of SMSFs in Australia has increased 11% over the last five years.

In addition to managing your own super investments, an SMSF also allows you the ability to borrow money.

This can involve

- You can use your SMSF fund for many investment options and one of these includes borrowing for the purpose of property acquisition.

- SMSF borrowing is also known as a Limited Recourse Borrowing Arrangement (LRBA)

- You can borrow money via your SMSF for investment into residential or commercial property.

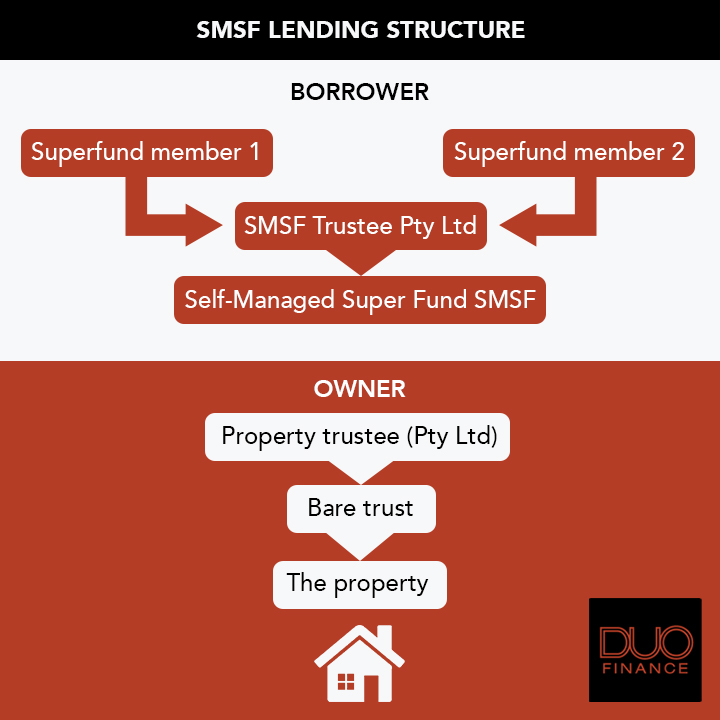

- Requires the establishment of a property trust in addition to your superfund trust so that you can borrow money.

- Is more complex borrowing and hence requires sufficient guidance from relevant experts such as your Financial Planner and experience Broker/Banker that understands the superfund space.

- You should aim to have a superfund balance of $250k plus for this type of investment to be effective and viable. If considering a commercial investment then this balance should be even higher in most cases.

Benefits of SMSF borrowing can be;

- Improved tax benefits vs borrowing outside of super (be mindful the benefit remains in the fund)

- Allows you to access your cash holdings in super towards the property purchase. Many people have more cash in their fund than outside which an make the property acquisition easier.

- Great opportunity for businesses to acquire their trading premises and use the cashflow eaten up for rent towards loan repayments. Ideally the cashflow position remains similar however now you can acquire a long-term asset.

- Standalone borrowing arrangement which is not linked via any other security or income you have personally – hence it is known as a LRBA

Possible disincentives of SMSF borrowing can be;

- It is a more expensive lending exercise that can carry larger upfront costs and interest rates compared with traditional lending for property

- If you do not have an existing SMSF, there are added costs to establish such as structure

- Requires annual audited financials in order for the superfund to be compliant

- Any failure for the fund to be compliant can cost you lots of money

- Limited number of lenders support SMSF borrowing

As with any investment decision, the key is to ensure you have as much information available to you so that you may make an informed decision. It is important that you engage a specialist Financial Advisor for this type of investment so they can consider your personal circumstance and help you determine if this is the right investment for you.

If you are considering an SMSF lending arrangement, Duo has the experience to assist in securing the finance and also providing the necessary introductions to Financial Advisors, Accountants, Lawyers etc. to ensure you have all aspects covered.

The above is general information about SMSF’s and should not be interpreted as specific financial advice for either individuals or businesses.